Tilly's: Multibagger with safety margin

0Thursday, January 3, 2013 by Unknown

I want to begin with my two cents on fashion retail category.

Fashion retail is a challenging business model. Essentially, you rent a box (real estate) at $x per sq. ft. & try to sale $y per sq. ft. at profit. It is a highly competitive business with relatively lower barrier to entry for many retailers. It is hard to control business's destiny when macro spending slows or peers engage in heavy discounting and mark-downs.

Unless you have an iconic brand such as Coach(COH), Michael Kors (KORS) or Kate Spade (owned by FNP), there is virtually little brand loyalty. You have to earn the loyalty every season for which you need to get the merchandise mix, price points, location and shopping experience right. Targeting a niche segment improves the odds of success. Ability to generate traffic is not enough unless it can be converted into profitable sales. Every season brings pressure to stay relevant to your audience. Fashion miss risk is much more pronounced for specialty (brand) retailers such as Abercrombie & Fitch (ANF), Urban Outfitter (URBN) etc. Fashion misses are hard to correct until the next season. But multi-brand retailers such as Tilly's (TLYS) and Zumiez (ZUMZ) have much less fashion risk.

In the midst of the difficult model, lies the big opportunity as well. If you get the concept right and execute it well, the unit growth opportunity can be huge. The operating leverage inherent with the unit growth phase means you could land a multi-bagger. Once in a while you get a compelling multi-bagger opportunity. Think ZUMZ in 2005, or A&F in the early 2000s. TLYS is one of those multi-bagger opportunities, I believe.

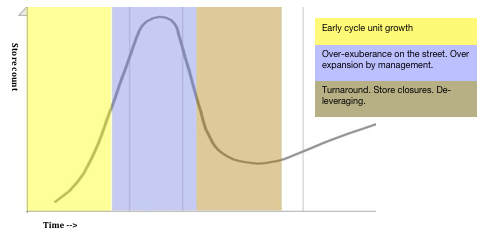

It also pays to understand the cycle of a retail franchise chain. Most fashion retails go through the hype cycle.

- If the concept is right and you can get in early, you can ride it through the unit growth phase.

- The early growth generates over exuberance on the street only to be matched by the over-expansion and financial leverage.

- Retail stocks crater when the reality hits. Store closures and de-leveraging follow. Shareholders bring in new management for turnaround.

Owning a stock in early cycle or betting on successful turnaround could be extremely rewarding. I believe, TLYS is an early growth cycle opportunity.

Investment Thesis

Tilly's is a multi-brand, action sports specialty retailer targeted at teens. By deploying a larger store format and offering a broad selection of merchandise, TLYS has positioned itself to be the fashion retail destination for teens. TLYS is in early innings. It's transitioning from regional to national chain, presenting a rare multi-bagger opportunity. At current valuation, you are buying 15-20% grower at ~10.75x (ex-cash) LTM earnings.

The recent pull-back (~25% down in past three months) presents an attractive entry point for long-term investors. It is time to load up…

Key highlights

- Multi-year growth potential - TLYS currently owns ~168 stores, out of which half the stores are California and two third stores are in three states CA, AZ FL. TLYS is positioned to grow at 15% per annum with the target footprint of 500 stores, representing a growth runway for 7-8 years.

- Compelling valuation - TLYS trades at 10.8x (ex-cash) LTM earnings, 6.25x LTM EBITDA.

- Adequate margin of safety - With strong cash flow, ~50M cash on balance sheet and 18 month cash on cash return on new stores, TLYS provides an adequate margin of safety.

Key to understanding the story:

- How large and convincing is the unit growth opportunity?

- Will the concept work in new markets?

- How does it differentiate from ZUMZ? Can they co-exist?

- New store economics

- Valuation

- How do you explain recent sell-off? What market might be missing?

How large and convincing is the unit growth opportunity?

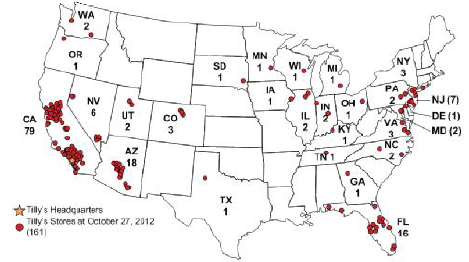

TLYS has 161 stores as of Oct 2012, with 1.27M square feet of store space. The company does ~ $350 per sq. ft. in sales. Almost half of the stores are in California, while 2/3rd of them are in three states i.e. California, Arizona and Florida. TLYS has 3 or less stores in 45 states of US. There is an opportunity to put many more dots on the map here. During the early unit growth cycle, the company also has the ability to pick the best locations given how large the green field is.

Source - Company Presentation

ZUMZ is the direct competitor and operates ~470 stores in United States. Just for comparison purposes, ZUMZ has grown from 176 stores in 2005 to 170 stores today. To me, the following chart puts it in perspective.

State

|

TLYS

|

ZUMZ

|

Difference

|

Colorado

|

3

|

16

|

13

|

Pennsylvania

|

2

|

15

|

13

|

Illinois

|

2

|

15

|

13

|

New York

|

3

|

27

|

24

|

Washington (ZUMZ HQ is here)

|

2

|

23

|

21

|

New Jersey

|

7

|

16

|

9

|

Texas

|

1

|

31

|

30

|

Wisconsin

|

1

|

12

|

11

|

Oregon

|

1

|

12

|

11

|

Source - SEC filings for TLYS & ZUMZ

Source - MapMuse*

* Blue dots on the map are ZUMZ stores. MapMuse information is bit dated, but it is primarily used to visually represent the gap between TLYS and ZUMZ.

Will the concept work in new markets?

Trends in eCommerce sales for TLYS confirm the opportunity in new markets -

According to the management, ~ 1/3rd of eCommerce sales are from the customers who do not have access to brick-and-mortar locations (within 50 miles). This trend reinforces the confidence in the expansion opportunity. The eCommerce sales for TLYS are 11% of total sales Vs ~7% for ZUMZ. This large difference in eCommerce sales share further confirm the opportunity.

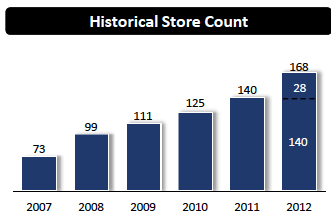

Past track record confirm the demand and ability to execute - During 2007 to 2011, TLYS has successfully doubled the store count and grown from 5 states to 14 states. This track record confirms the opportunity as well as management's ability to execute.

Source - Company Presentation

Nationwide presence of target customer - TLYS caters to the teen lifestyle and positions itself as a retail destination. The action sports, teen retailer category has matured from the niche fashion to the mainstream and everyday lifestyle. The target demographic is present in all the states. The action sports lifestyle is relevant in all pockets of the county from urban, sub-urban to rural.

The successful expansion of ZUMZ from 176 stores in 2005 to 470 stores in 2012 is another proof point in support of category growth.

How does TLYS differentiate from ZUMZ? Can they co-exist?

To me, this was one of the most important questions during my research. It is important to understand who the customer is for TLYS.

The biggest differentiation between these two retailers relates to the box size. TLYS average store size is 7,900 sq. ft. Vs. 2,900 sq. feet for ZUMZ. How many multi-brand retailer you can name with a 3000 sq. ft. box?

For a multi-brand retailer, the floor space size determines the ability to display and carry merchandise mix. With a larger store format, TLYS can target more niche segments and broader merchandise offering.

During my store checks, I have often noticed that the many of the hot selling/trending TLYS items are also the ones not carried by ZUMZ. Note - This is an anecdotal observation and not a hard evidence.

Some more important differences:

- ZUMZ has a much narrow focus on action sports lifestyles such as skateboarding, snowboarding and surfing. While TLYS targets these categories as well as more niche action sports such as Motocross, NASCAR in addition to music, art and fashion.

- ZUMZ is targeted towards hardcore action sport participants, while TLYS store is targeted towards the action sport enthusiast. TLYS targets the customer base who aspire to or casually participates in the action sports.

- ZUMZ dedicates a lot of space for skateboard counter compared to TLYS. ZUMZ also offers skateboard accessories and repairs and hard goods makes up a meaningful of ~11% of their sales.

- ZUMZ is mostly mall-based stores. TLYS has 50/50 mall and off-mall store base.

Both the chains have co-existed in California very successfully. There is no reason why it would not work in rest of the country. ZUMZ has 77 stores in California, while TLYS has 78. Many of these stores are located in the same mall.

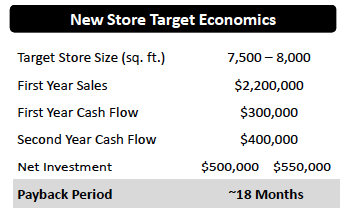

What are the new store economics?

If you believe into the unit growth thesis, you would want to know the new store economics next.

Opening a new stores requires ~500K-550K in capex and generates 2.2M in sales during the first year. The cash on cash payback period for a new store is 18 months. The compelling new store economics and the inherent operating leverage in the model will bring strong earnings growth even without the help of improvement in the same stores sales comps.

TLYS management thinks the franchise potential is 500 stores & guided to a 15% per annum growth in store count. This represents a 7-8 years of growth opportunity.

Source - Company presentation

TLYS is a cash-generating machine. Growth can be funded through operating cash flows.

The cash on hand and the ongoing operations are more than sufficient to fund the future growth. TLYS has a strong balance sheet with ~$50M cash on hand. TLYS is a cash-generating machine. During 2010 and 2011, company generated ~$94M in operating cash flow. Even after spending $36M in cap-ex and opening 29 new stores, TLYS generated free cash flows of ~$57M during those two years.

Past investments have positioned the company for growth and strong execution

During past five years, company has invested over $20M in infrastructure and systems. The company has made significant investments in its IT systems and distribution infrastructure. I had an opportunity to visit company's distribution center in Irvine. The distribution center is highly automated and it creates the shipment in floor-ready format. The entire distribution infrastructure is built around being agile and making frequent deliveries to the store. Currently, the average utilization of the distribution center is a single eight hrs shift. The distribution center is built to support the 500 store growth objective. Given the back-end readiness, expect further improvement in the operating leverage via reduction in G&A.

The company typically delivers the shipments to stores 5x a week, allowing it to dynamically respond to the trends and store feedback. The company uses its own fleet to ship merchandise to the local (Southern California) stores and third-party distributors for stores outside of So Cal. As the store density improves, there is further leverage in reducing the logistic costs by bringing the distribution in-house.

Tremendous operating leverage

TLYS will also benefit from the tremendous operating leverage inherent in the unit growth phase of the retail business. Here are some of the key things to note. TLYS will benefit from SG&A leverage. With the scale, G&A leverage will kick in. As the geographic expansion provides sufficient regional store density, the distribution and selling cost leverage will kick-in. With the maturity of new stores, the occupancy leverage will kick-in. Expect the operating leverage to further contribute to the profits on top of the contribution from unit growth and SSS comps improvements.

Why recent sell-off?

TLYS stock is down in sympathy with ZUMZ. ZUMZ is down on softer comps over past three quarters. Remember, ZUMZ is coming off a very strong comp base from 2011. ZUMZ is also coming off a much higher valuation than TLYS.

Note - ZUMZ is also a terrific franchise run by top-notch management team. However, I like TLYS more because of better visibility, longer growth runway and more favorable risk/reward.

Is market mis-reading SSS comps?

TLYS sold off recently on de-accelerating comps in Q3. However, consider the following:

- Very high base - The comps are coming of a very high base for 2011.

- California exposure - SSS comps include 130 comparable brick-and-mortar stores, 60% of which are in California. Sales in California came in softer, potentially because of the temporary spike in gas prices (as high as $6 a gallon) due to refinery issues on the west coast. Footwear also came in softer which was evident across the category. These are temporary issues and do not suggest any change in the long term thesis for the franchise.

Reminder - there are 31 non-comparable brick-and-mortar stores because these have not completed 12 months at the time of reporting.

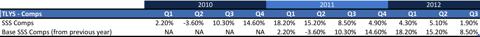

Source - Company SEC filings

Street tends to worry too much about SSS comps from quarter to quarter. SSS comps are important because they indicate the incremental growth & the category growth. But what is important to understand is that the source of growth for TLYS is really from the unit growth. The operating leverage and new store economics could pick up the slack from softer SSS comps.

Given the long term opportunity, I would not worry too much about slight de-acceleration in the SSS comps.

Is the category growing? Or are the players stealing share from each other?

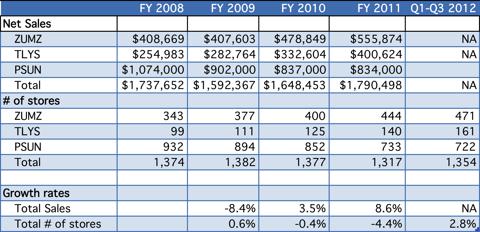

The actions sports multi-brand retailer category has been clearly growing. Consider the combined store base and net sales for ZUMZ, TLYS and PSUN. This is not a complete list but these are primary multi-brand retailer (destination retailers). I wanted to use these three franchises to illustrate the trend.

Interpretation - What is happening here is that TLYS and ZUMZ are creating a one-stop destination for action sports, teen shoppers. As a result, they are stealing a little share from many (branded) specialty retailers. TLYS and ZUMZ carry over 100 third party brands. None of the other specialty retailer brands can provide a full range of offering. Most of the expansion for ZUMZ and TLYS is coming from going into new geographies. Under-penetrated markets and the maturity of existing store base should support the future growth.

Financial Overview

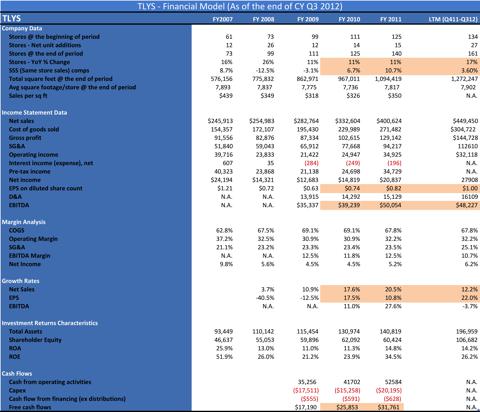

Here is the historical overview of the company. Few things worth noting:

- Strong positive comps. FY10 comps of 6.7%, FY11 comps of 10.7% and LTM comps of 3.6%

- Strong EBITDA trends. FY10 $39M, FY11 $50M and LTM $48M

- High quality growth. Net sales as well as EPS growth.

- Net sales growth FY10 17.6%, FY11 20.5%, and LTM 12.2%.

- EPS growth FY10 17.5%, FY11 10.8%, LTM 22%

- Strong free cash flow (ex-distributions). FY10 $25.8M, FY11 $31.7M

Source - Company filing.

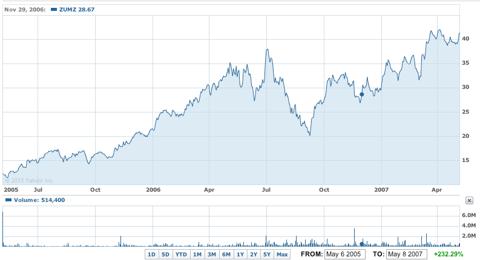

Trading psychology

TLYS lacks the history as a publicly run company. In terms of market cap, it is closer to a micro cap/small cap line. As the company executes successfully and establishes track record as a public company, it wont be long before the stock takes off. Consider how ZUMZ trades for first two years as a public company.

Management team

TLYS is run by very competent and experienced management team.

Mr. Hezy Shaked is the Chairman and Chief Strategy Officer. He is a co-founder and has been with the firm since 1982.

Mr. Daniel Griesemer is the President and Chief Executive Officer. He joined TLYS in February 2011. He has been in retail over 28 years. He served in various roles with Coldwater Creek, Inc. from 2001 to 2009 including most recently as Chief Executive Officer. During his tenure, Coldwater Creek increased the store base from 13 to approximately 400 and increased revenues from approximately $340 million to approximately $1.1 billion. Mr. Griesemer also served in leadership positions at Gap, Inc. and Macy's, Inc.

Mr. Bill Langsdorf has served as Senior Vice President and Chief Financial Officer since February 2007. Prior to which, he has served in CFO position with many firms including Anchor Blue, Wet Seal and House2Home, Inc. (formerly Home Base, Inc.). Prior to joining Home Base in 1986, Mr. Langsdorf was a Manager in the consulting practice of Ernst & Young LLP (formerly Arthur Young & Co.).

Valuation

I am aware of the inherent bias involved in creating detailed projections because you are more likely to believe in the preciseness of your own model. However, they do help put the potential upside in perspective.

The 15% unit growth can contribute to 15% earnings growth, if the comps are operating margins remain at the current levels. The operating leverage or SSS comp improvement can contribute to another 500 bps.

Company earned $1 in LTM. For FY 12, company has guided for 89c-91c earnings. For the projection, I will take mid-point of 90cents earnings in FY 12.

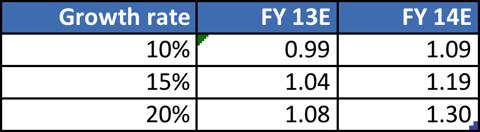

Earnings estimates scenarios

Potential valuation scenarios

Company holds ~$2 per share cash. Valuation assumes a $3 in cash by the end of FY 14. In the base scenario, TLYS could be worth $27-32 over next two years.

Conclusion

Tilly's transition from regional to national chain represents a very compelling multi-bagger opportunity. TLYS is positioned to grow at 15% per annum with the target footprint of 500 stores, representing a growth runway for 7-8 years. By deploying a larger store format and offering a broad selection of merchandise, TLYS has positioned itself to be the fashion retail destination for teens. TLYS is in early innings. At the current valuation, you are buying 15-20% grower at ~10.75x (ex-cash) LTM earnings.

It is time to load up..

Note - Email me to receive the financial model in Excel.

Disclosure: I am long TLYS.

Additional disclosure: Email me to receive the Excel model.I have spent significant time following the company since its IPO. I have met CFO, visited the company’s head quarters, distribution center, number of company stores and competition’s stores. The article is more focused on the analysis of the opportunity than the stating the facts about the company’s current operations.

HF - Profit from 1.7T CRE re-fi boom

0Tuesday, December 18, 2012 by Unknown

Upside potential: 50% in less than a year.

Investment thesis

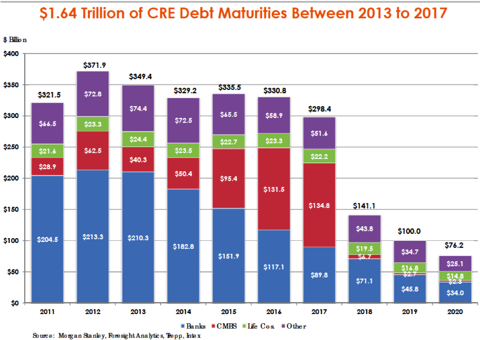

HFF is trading at ~9x earnings (ex-cash) & ~5x EBITDA. HFF has been making early cycle investments to take advantage of the coming re-fi boom from the 1.64Trillion in CRE debt maturing between 2013-17. HFF has been making early cycle investments to take advantage of this opportunity.

CRE debt re-fi opportunity is going to provide a strong source of deal flow irrespective of the economic conditions. So, here you have a company with strong growth prospects irrespective of the macro conditions. If the recovery picks up next year, it will improve the CRE sales activity and provide further tailwind.

How does the business work?

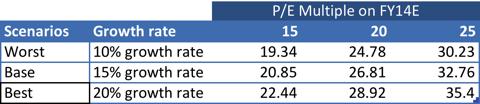

Source - HFF Company Presentation

HFF clients are the owners of various types of properties such as office, retail, industrial, hotel, multi-housing, self-storage, assisted living, nursing homes, condominiums and land. HFF offers its clients a range of debt instruments such as construction loans, adjustable and fixed rate mortgages, mezzanine debt, forward delivery loans etc. HFF also offers investment banking, loan sales, distressed asset sales and commercial loan servicing services. However, debt and investment sales are the bread and butter of the business. 90% of its revenues are from capital markets services fees. All the fees are usually negotiated on a transaction-by-transaction basis. On the capital provider side, HFF works with life insurance companies, conduits, investment banks, commercial banks, thrifts, agency lenders, pension funds, REITs, credit companies and individual investors. HFF brings a deal to all the capital providers. Whoever offers the best quote (and terms) wins the business. HFF does not compete with its clients or capital provider partners. HFF has a highly diversified revenue base. No client represents more than 2% of revenues.

Key business drivers

HFF earns transaction based revenues. The volumes and activity level (deal flow) in the CRE markets is the key macro driver that affects HFF's business.

Geographical presence is important because you need feet on the grounds to execute the deals. Brokers (producers) personnel are the key to the business. The relationships with the property owners and capital providers are crucial for deal flow. Given the high touch nature of the business, expansion of staff or locations takes careful planning and long lead times.

For the producers, bonus makes up a significant portion of remuneration because of "You eat what you kill" nature of the business.

Cyclical Opportunity

I want to discuss the trends and opportunities with the debt re-fi, distressed debt and investment sales segments in the CRE market.

Debt re-fi opportunity

CRE debt deals done during heydays of late 2004-07 are coming due. 1.64T of CRE debt is due between 2013-17 (Source - HFF company presentation).

Source - HFF Company Presentation

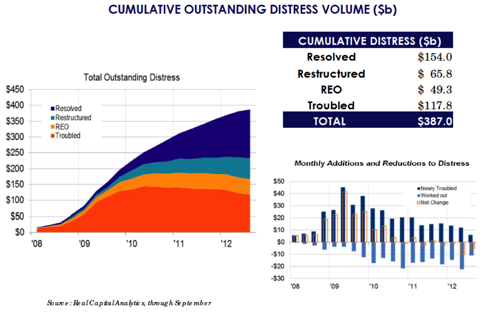

Distressed debt opportunity

$230B of outstanding CRE debt is estimated to be distressed. The distressed loan needs resolution in the form of restructuring, extension or liquidations etc. HF has role to play in those transactions as well.

Source - HFF Company Presentation

Investment sales opportunity

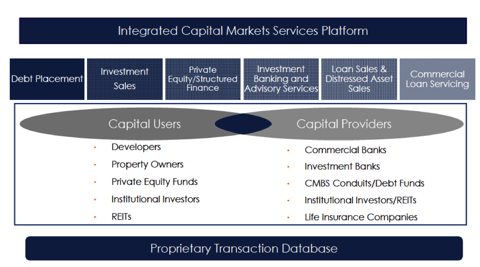

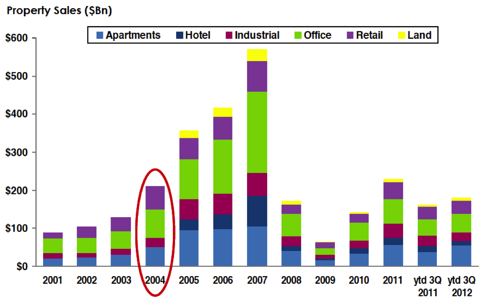

Investment sales volumes are significantly down from the peak, but have started to pick up and are back to 2004 levels. Mean reversion of property sales to normalized level will provide further tail wind to the HFF's business.

Source - HFF Company Presentation

Early cycle investments

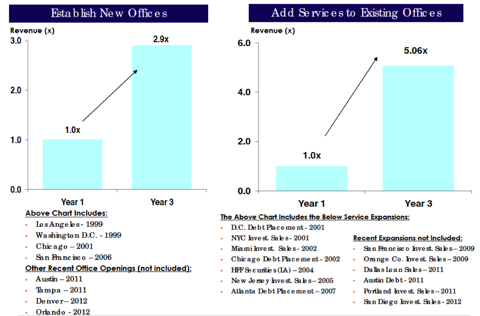

As I pointed out earlier, adding capacity takes time given the relationship based nature of the business. HFF has been making early cycle investments and is well positioned to take advantage of this cyclical opportunity. Here is how?

- HFF has been increasing footprint. HFF has added four new offices in CY 2011 and 2012 in Austin, Tampa, Denver and Orlando.

- Over past two years, HFF has also been adding new services to their existing offices.

- Most importantly. HFF has been aggressively adding production professionals. Since 2010, HFF has increased number of brokers by a third. HFF has added 55 new production professionals, taking the total of production professionals from 159 to 214.

Maturity curve for the new capacity

In my view, understanding the maturity curve for new capacity is the key to understanding the story.

According to the CEO, a new analyst starts producing at peak in 3-5 years while an lateral hire starts producing at peak within 2-4 yrs from the time of hiring. (Source - conference call transcripts). The new hires from 2010 are probably going to hit the peak in 2013 and 2014.

In the past, adding new services to an existing office has increased revenues to 5x in three years. While opening a new office has shown revenues tripling by the third year. The investments made in expansion since 2010 will start showing significant returns beginning next year.

Source - Company presentation.

HFF has also been gaining market share. Market share growth in origination volume of HF Growth Vs Industry Growth.

- 2011: HF 87% Vs Industry 55%

- 2010 : HF 88% Vs Industry 44%

Competition

HFF Competes with CBRE(NYSE:CBG),Jones Land LaSalle (NYSE:JLL) and Cushman & Wakefields of the world. The key difference with HFF is that it does not compete with clients and capital providers, unlike some of its competitors.

Valuation

HFF trades at 9x (ex-cash) earnings & ~5x EBITDA.

CBG and JLL trade at ~12-15x earnings & ~8-9x EBITDA.

HFF is a pure transactional company should trade at some discount to its comps which have revenue mix of contractual and transactional fees.

What is street missing? Why it may be trading cheap.

- HFF results can be lumpy. Street has not fully adopted to the lumpiness in HFF's business perhaps because HFF comps are not that lumpy. Street focuses too much on quarter to quarter volumes.

- HFF has limited coverage. CBG, JLL are large cap, better owned and better covered.

- HFF is an easier to own when volumes are growing instead of when volumes are sideways.

- But as the cyclical opportunity in CRE re-fi realizes and market gets more clarity, expect the earnings to improve and multiple to expand as well.

Price Target

HFF has no corporate debt and $4.10/sh cash. The management team is very conservative. Insiders own 29% and management/shareholder interests are well aligned.

The cash position of the company and the assured deal flow volumes from the debt re-fi opportunity should limit the downside.

HFF will do ~70M in EBITDA this year. Even a modest growth of 15% from volume pickup will put them at 80M EBITDA next year.

As market gets more clarity on the volume growth, HFF shareholders will be rewarded with a higher multiple. I am putting $20-22 price target on HFF common stock, representing 50% upside in less than a year.

Disclosure: I am long HF.

Email me to receive a more detailed thesis (powerpoint deck).

Category Commercial Real Estate, CRE, HF, HFF, Speciality financials

Powered by Blogger.