Archive for 2012

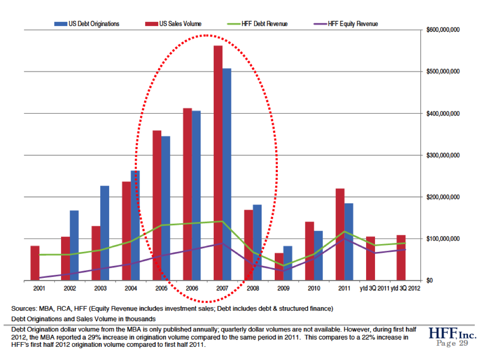

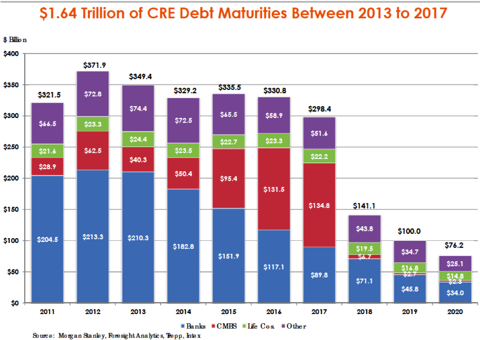

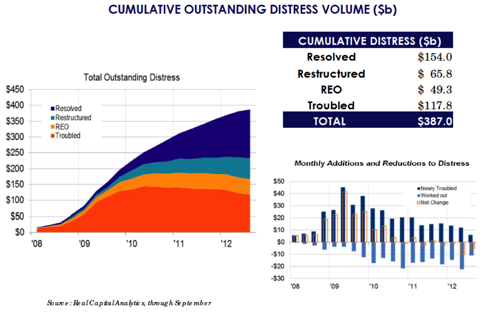

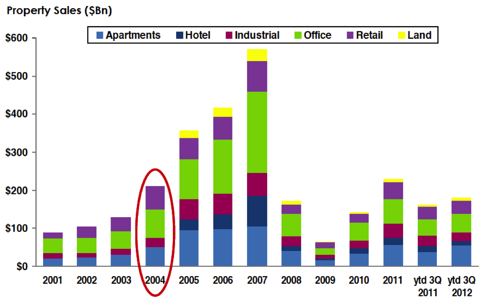

HF - Profit from 1.7T CRE re-fi boom

0Tuesday, December 18, 2012 by Unknown

Upside potential: 50% in less than a year.

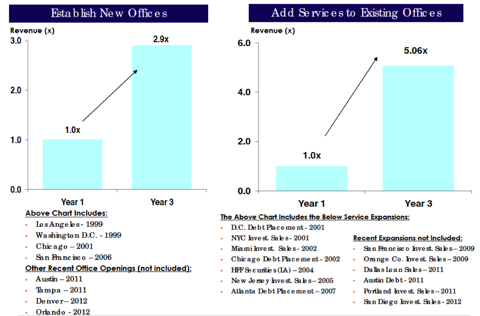

- HFF has been increasing footprint. HFF has added four new offices in CY 2011 and 2012 in Austin, Tampa, Denver and Orlando.

- Over past two years, HFF has also been adding new services to their existing offices.

- Most importantly. HFF has been aggressively adding production professionals. Since 2010, HFF has increased number of brokers by a third. HFF has added 55 new production professionals, taking the total of production professionals from 159 to 214.

- 2011: HF 87% Vs Industry 55%

- 2010 : HF 88% Vs Industry 44%

- HFF results can be lumpy. Street has not fully adopted to the lumpiness in HFF's business perhaps because HFF comps are not that lumpy. Street focuses too much on quarter to quarter volumes.

- HFF has limited coverage. CBG, JLL are large cap, better owned and better covered.

- HFF is an easier to own when volumes are growing instead of when volumes are sideways.

- But as the cyclical opportunity in CRE re-fi realizes and market gets more clarity, expect the earnings to improve and multiple to expand as well.

Category Commercial Real Estate, CRE, HF, HFF, Speciality financials

David Einhorn interview notes

0Tuesday, February 28, 2012 by Unknown

- At Greenlight, we don't start with what is cheap? We start with the what is mispriced/misunderstood (Note - This was a big revelation to me about his investing approach.)

- If it is mispriced or misunderstood, we will see if it is cheap too.

- Insights about investment process

- When you are screening for stocks that may be misunderstood, it is important to rule out the false positives quickly.

- The main thing is to figure out what may be mispriced.

- We want to understand

- what world thinks about the stock.

- Then see what we think about the stock is different from it.

- If it is different, go out and test it.

- You have to read stuff, think about it and then talk to people.

- Wisdom

- Each investment is like a puzzle.

- Additional quote from another interview with David Einhorn- “Investing is like solving the puzzles. I think that what you are dealing with here is incomplete information. You’ve got little bits of things. You have facts. You have analysis. You have numbers. You have people’s motivations. And you try to put this together into a puzzle — or decode the puzzle in a way that allows you to have a way better than average opportunity to do well if you solve on the puzzle correctly, and that’s the best part of the business.”

- In investing you are trying to solve the puzzle. Future is the range of possible outcomes.

- Sometimes people have agenda in misinforming you, so you have to be careful about it.

- AAPL - Apple

- Largest position for the fund.

- Given the consistent outperformance of APPL stock, I have come to believe that even large caps are inefficient.

- Ex-cash, stock trades at 8x earnings. AAPL will earn close to $45-50 per share next year (using a very conservative estimate). It has close to $100 on it's books.

- Market assigns a low multiple on it. (At the time of the discourse, AAPL stock was trading at around $490 per share)

- People think it is a hardware company. Market has bad experience with hardware companies. Think RIMM, Motorola

- According to him, AAPL is a recurring revenue business.

- When people buy one product, they tend to go out and buy multiple Apple products.

- iPhone

- 95% of the customers upgrade to the next version of iPhone. Very high loyalty.

- People are not going to abandon iPhone because the other phone has better feature (say camera or screen size).

- The competition will have to come up with a lot better phone to cause iPhone customers to switch out of iPhone. Marginal and few feature improvements wont cut it.

- Phones wear out in 2 years. There is a natural upgrade cycle.

- Apple has a history of low capex, low R&D and no crazy acquisitions. So, you know wont blow away the cash some day.

- APPL is really an annuity business.

- Lot of optionality with TV business. AAPL went through three revolutionary products : iPod, iPhone and iPad. They will do TV, only if they can revolutionize it.

- You can do lot of things with Siri on Apple TV. Think about it. You can talk to your TV - "Play the last 2 mins of Superbowl". You can watch the Manningham catch (link) as many times as you like. (Very compelling)

- Japan

- Loosing money on short yen position.

- It is a negative carry investment. So, you loose money every year. Everyone hates it. But, it has a potential off paying of big time.

- He thinks the Japan situation is a stable dis-equillibrium.

- WAG - Wallgreen (Is Walgreen misunderstood?)

- David was asked about an example of the company that his fund studied but passed the opportunity to invest in it.

- Wallgreen's may loose customers permanently. When the ExpressScript customers cannot buy from Walgreen, they will take their business to another pharmacy. When the dispute is resolved, these customers may not come back to Walgreen. They may continue doing business at the other pharmacy. People don't switch pharmacies easily. It's a habit. It means the permanent loss of customer.

- Eventually the dispute with Express Scripts will be settled.

- Other may want the same treatment as ExpressScript. WAG may be forced to renegotiate the terms with other providers too.

- RIMM

- It has a critical mass problem.

- It has a reasonable balance sheet.

- It may not evaporate as fast as anticipated.

- Negative bet (Shorting) on RIMM does not make sense at current valuation.

- Advise

- Avoid what may hurt you while you are waiting on your thesis to play out.

- Have a basket of bets.

- JOE

- It's a concept stock that has run into a math problem.

- Book value is approx. $7 per share.

- Assume 9% growth in real estate values. There will be 2% carrying cost. It will take 10 years for the book value to double (which is close to the stock's price of close to $14.50 at the time of interview)

- Another example of inefficiency in the large cap : Coca-Cola in late 90s

- Coca cola was showing consistent earnings growth and the stock had a very high multiple.

- But the earnings were coming from selling the bottling units. It cannot last forever.

- It was a non-recurring revenue.

Category Columbia Business School, CSIMA, David Einhorn, Greenlight Capital, Value Investing Conference

Dan Loeb, Dan Krueger - Interview notes

0by Unknown

CSIMA Conference : Value Investing Conference at Columbia (Feb 2012)

- Started fund in 1995. Currently employs 65 people.

- Core american value are entrepreneurial, competitiveness and individual freedom.

- It's all about getting the right people.

- 50-100 bps as hedging budget is typical.

- Likes sinky feet companies i.e. when a company is proposed and your immediate reaction is its a stinky company. That is where some of the best ideas are found.

- Our framework is relatively constant, but process has evolved.

- Wisdom

- Recommends book Checklist Manifesto (link)

- Recommended book Art of Learning (link) Note - I read the book based on his reco. It's an amazing book.

- If you are reading research reports all the time, you will fail.

- Investing is for all rounded people. (Note - Daniel is an incredibly smart and a very well rounded person. He is an avid adventurist and well known for doing different things)

- His advise - Go out and see the world. You should be able to switch off from time to time.

- Recommends looking at Santa Fe institute (link), if you want to understand the underlying modalities of decision making.

- Daniel Krueger

- In Europe, the combination of austerity and de-leveraging presents a perfect storm.

- High yield implied 7% default rate.

- Deleveraging by the financial institutions in Europe can present interesting opportunities. There will be a lot of forced sellers.

- In distressed, you dont want to be all-in all the time. I would rather pay little bit more for a good business, than get a crappy business.

- In distressed credit, it is all about understanding asymetric bets.

- Emphasized the importance of process over outcome. Process is extremely important, because it is used over and over again.

- Measure and judge your process.

- Good outcome and bad process is particularly very dangerous.

- Even in declining industries, look for companies with low capex, low R&D and history of no crazy acquisitions.

- In distressed investing, it is extremely important to be a person of good integrity, because the same people will be working with you over and over again.

- Price is a short term opinion of the people in the market.

- Investing is like a jig-saw puzzle where the pieces are not supposed to fit perfectly.

- It's very easy to re-regurgitate other's opinion (I think he meant particular the research of the sell side analysts). People can talk from the hip. Doing primary research is extremely important.

Agenda : Distressed Investing

Category Columbia Business School, CSIMA, Daniel Krueger, Daniel Loeb, Distressed Value Investing, Owl Creek Capital, Third Point Capital, Value Investing Conference

Bruce Barkowitz interview - notes

0by Unknown

CSIMA Conference : Value Investing Conference at Columbia (Feb 2012) : Notes 3 of 5

- Bruce Berkowitz

- Top lessons for life

- Cash is king. You have to have it. Best way to hedge.

- There is no free lunch. If it is free, its not a lunch.

- You can't change people (others).

- You will only see reality (of people) under extreme stress. That is when facades melt.

- Volatility is not risk

- Always assume bad luck

- You should need only few variable to win, at the most 3 or 4. Otherwise, your odds weaken.

- If you need maths above 6th grade, you are in trouble.

- Checklist

- Can you kill it? (Meaning is there a very big upside on the stock?)

- Is there an adult supervision at the company? (Meaning - Board of director and/or Chairman is experience, competent and capable of reigning in a distracted CEO.

- Is the company essential?

- Do the company depend on strangers (read bankers?)

- Can the company die?

- Is the company picking pennies in front a steam roller?

- How is the company balance sheet - Assets, current assets, change in current assets

- Management - Past, present. Does the management walk the talk?

- Classic model in picking misunderstood stocks

- Is the problem fixable?, when a company's stock is massively sold on a specific business problem

- Is there a market aversion to a certain industry, sector?

- Company belonging to the industry where the market (investors) has burnt massively.

- Misunderstood companies

- CIT, AIG, MBIA are misunderstood.

- Holding companies :

- SHLD - Sear Holdings

- BRK - Berkshire

- LUK - Leucadia National

- Financials

- Financials fit with the mental models. Current environment is similar to 80s and 90s.

- You just have to survive now, to be a big winner later.

- You have to realize that contracts have average life. They expire. Really good times lead to bad time and vice-versa.

- SHLD

- It's misunderstood.

- You have to understand the history of malls yo understand and appreciate the history of K-marts. If you do, you will look at real estate of SHLD very differently.

- Note - I think Bruce is referring to the idea that malls will be willing to make the concessions in order to keep SHLD stores open

Category Bruce Barkowitz, Columbia Business School, CSIMA, Fairholme Funds, Value Investing Conference

Whitney Tilson, Michael Karsch discussion notes

0by Unknown

- Whitney Tilson

- Netflix (NFLX)

- When we shorted NFLX, momentum in the stock and business worked against us.

- Our original thesis, NFLX needs to invest heavily and its margins cannot be maintained, is still intact.

- There was a repeated question about what change in NFLX for Whitney to go from short to long. He said its the stock price that changed.

- BRK

- Buffett is willing to buy it at 110% of book value, that provides a floor.

- 8% downside and 50% upside to the stock.

- Lack of catalyst is holding the stock back. But cheapness becomes its own catalyst eventually.

- Refer to Whitney's latest take on Berkshire at http://www.tilsonfunds.com/BRK.pdf

- Wisdom

- Quoted Munger : Shorting is a terrible business but young people seems to want to learn this on their own.

- Dont fall it "I missed it" trap. It is common that you look at the stock after the pop and think you missed it. His advise - "Stop and re-do your work." It does not matter where the stock was before.

- Talked about his 10X10 idea. Companies trading at 10B+ market cap and above 10x revenues. (Note - Get on Whitney's email list. Whitney has sent follow-up to this idea.)

- Recommended

- Temperament guides your investment process.

- Risk is a function of liquidity that you have.

- In the long short business, gross is more important than the net.

- Best investing advise : When you think you are too long, get ride off the longs with lowest conviction and vice-versa.

- Need to be double good (than the long only investor), to be successful on short side.

- Keep open mind and show respect of technicals.

- What gets hedge funds in trouble? a) swinging for fences, b) leverage and c) risk addiction.

- Types of shorts

- Outright frauds

- Broken momentum on a very high valuation, growth stocks

- Earnings miss on a very high valuation, growth stocks

- Value traps (e.g. gradual but irreversible decline)

- Even obvious shorts can be dangerous because of unexpected events. e.g. L3 looked like a bankrupt stock. But an outside investor came in, recapped the company and saved it.

Category BRK, Columbia Business School, CSIMA, Long Vs Short, Netflix, Value Investing Conference, Whitney Tilson

Bill Miller interview notes

0by Unknown

Rare Interview with Bill Miller

- Insights on equity markets

- Likes stocks that provide protection against inflation as well as economic slowdown.

- Throughout great recession, corporate profits outperformed the macro.

- Even if economic activity deteriorates from hereon, underpinning of the businesses won't do that bad.

- In recent years, business cycle turned from expanding credit to de-leveraging.

- S&P 500 companies in 2011: Top line grew 12%, Earnings grew 15% but market was flat.

- Look for companies with reliable dividends.

- LTRO marked the bottom of financials in Europe.

- 2008 crisis was a balance sheet and collateral crisis. That makes it unique.

- Growth stocks

- You are likely to make mistake in either

- a) Duration - How long the growth lasts,

- b) Magnitude - How fast it grows?

- When evaluating growth stocks. focus on

- a) Is the competitive advantage sustainable?

- b) Is the return on capital greater than cost of capital.

- AMZN

- AMZN's business required high upfront investment to get it off the ground. During 2000s, market was willing to finance it via high valuation of the stock.

- The key question is - what is the operating margin in the long term.

- It seems that Amazon wants to keep the operating margins low for its AWS (Amazon Web Services) business.

- AMZN is likely to keep low margins for a considerable time.

- All retailers are having a revelation now. AMZN is to them, what WMT was to K-Mart and Sears.

- Retailer does not know much about you. AMZN knows so much about you.

- Value driver is still the sales growth.

- Amazon is in a dis-inter-mediation business.

- Prime membership is modeled after Costco's membership model.

- Amazon has already disrupted books business. Disruption in electronics goods is in progress. Also, successfully competed in a high touch, high value business using Zappos.

- GOOG

- Google has internal issues with the discipline in capital spending.

- Valuation is very compelling.

- Tremendous optionality at current valuation.

- Growth rate with GOOG is farely linear, unlike facebook. GOOG is a relatively matured business.

- It is difficult to do projections on Facebook, because the growth rate is not linear.

- Wisdom

- General propositions don't determine the concrete cases.

- Try to figure out exceptions to the base rate.

- Advise on starting fund in today's market. Be different & be right. You will do very well.

- Business lesson from personal experience - To retain business and AUM (Assets under management), avoid loss aggregation. You will be wrong from time to time and incur losses. Do not allow losses to aggregate.

- In today's markets, historical valuation is less pertinent as we have moved from credit expansion to deleveraging.

- Permanent loss is really bad.

- 2008 experience made people go defensive very quickly in (Aug-Sept) 2011.

- Bond market sell off will be very positive for equity markets.

- Themes

- Housing stocks look very bullish. The recent uptrend in New housing starts is very encouraging.

- Insurance companies that are trading below book value look very interesting.

- Airlines

- Major consolidation in airlines industry in recent years.

- The economics in airlines are turning around. Historically, the industry was dominated by cut throat competition.

- After recent mergers, Delta (DAL) and United (UAL) control more than 50% of market share.

- Airline companies are showing +ve free cash flow, +ve ROE for over two years since 2009.

- Balance sheets are getting stronger.

- Picks

- United (UAL) is most balanced of the airlines. United has more than $5 in free cash flow. Its debt could become investment grade in 18 months.

- US Airways (LCC) is a highly levered (high beta) bet.

- Alaska Airlines (ALK) is among the safest. (Note - This is my personal favorite. No debt, good cash and niche and less competed routes)

- Banking

- In response to a question about how to assess banks assets. You don't know exactly what they hold. Look at the category of assets such as agency mortgages, non-agency etc.

- Banks as a group are mispriced. The relative discount between banks is not all that great.

- BAC will be the biggest beneficiary of housing recovery.

- Potential tail risks

- Oil prices

- Policy errors in Europe

- Liked Nestle. Company had steady margins even during the great recession and commodity shock.

Category Airlines, ALK, AMZN, Bill Miller, Columbia Business School, CSIMA, DAL, GOOG, UAL, Value Investing Conference