Archive for December 2012

HF - Profit from 1.7T CRE re-fi boom

0Tuesday, December 18, 2012 by Unknown

Upside potential: 50% in less than a year.

Investment thesis

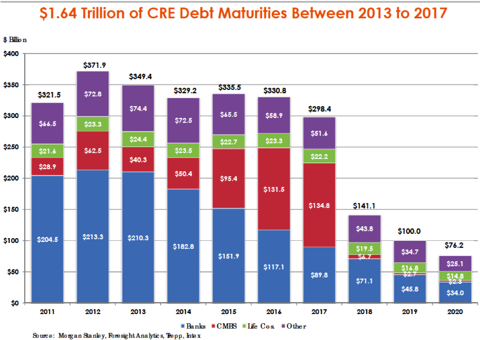

HFF is trading at ~9x earnings (ex-cash) & ~5x EBITDA. HFF has been making early cycle investments to take advantage of the coming re-fi boom from the 1.64Trillion in CRE debt maturing between 2013-17. HFF has been making early cycle investments to take advantage of this opportunity.

CRE debt re-fi opportunity is going to provide a strong source of deal flow irrespective of the economic conditions. So, here you have a company with strong growth prospects irrespective of the macro conditions. If the recovery picks up next year, it will improve the CRE sales activity and provide further tailwind.

How does the business work?

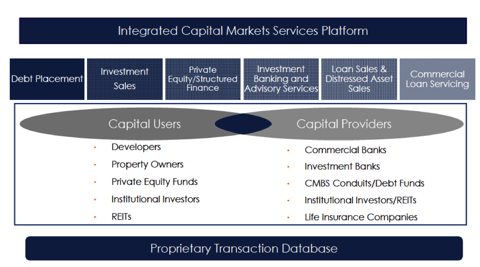

Source - HFF Company Presentation

HFF clients are the owners of various types of properties such as office, retail, industrial, hotel, multi-housing, self-storage, assisted living, nursing homes, condominiums and land. HFF offers its clients a range of debt instruments such as construction loans, adjustable and fixed rate mortgages, mezzanine debt, forward delivery loans etc. HFF also offers investment banking, loan sales, distressed asset sales and commercial loan servicing services. However, debt and investment sales are the bread and butter of the business. 90% of its revenues are from capital markets services fees. All the fees are usually negotiated on a transaction-by-transaction basis. On the capital provider side, HFF works with life insurance companies, conduits, investment banks, commercial banks, thrifts, agency lenders, pension funds, REITs, credit companies and individual investors. HFF brings a deal to all the capital providers. Whoever offers the best quote (and terms) wins the business. HFF does not compete with its clients or capital provider partners. HFF has a highly diversified revenue base. No client represents more than 2% of revenues.

Key business drivers

HFF earns transaction based revenues. The volumes and activity level (deal flow) in the CRE markets is the key macro driver that affects HFF's business.

Geographical presence is important because you need feet on the grounds to execute the deals. Brokers (producers) personnel are the key to the business. The relationships with the property owners and capital providers are crucial for deal flow. Given the high touch nature of the business, expansion of staff or locations takes careful planning and long lead times.

For the producers, bonus makes up a significant portion of remuneration because of "You eat what you kill" nature of the business.

Cyclical Opportunity

I want to discuss the trends and opportunities with the debt re-fi, distressed debt and investment sales segments in the CRE market.

Debt re-fi opportunity

CRE debt deals done during heydays of late 2004-07 are coming due. 1.64T of CRE debt is due between 2013-17 (Source - HFF company presentation).

Source - HFF Company Presentation

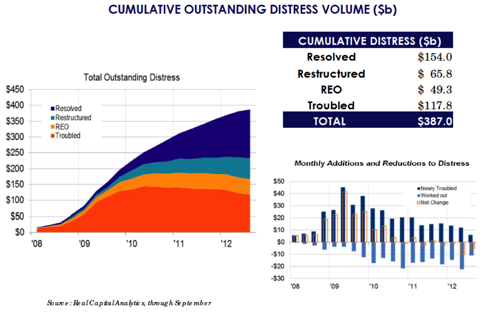

Distressed debt opportunity

$230B of outstanding CRE debt is estimated to be distressed. The distressed loan needs resolution in the form of restructuring, extension or liquidations etc. HF has role to play in those transactions as well.

Source - HFF Company Presentation

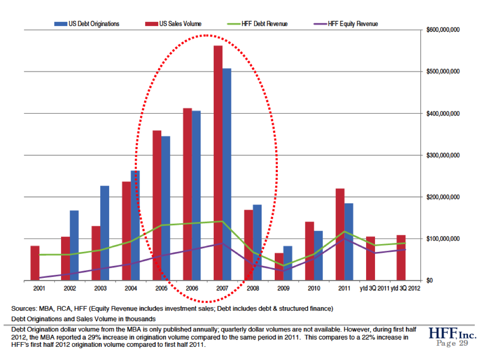

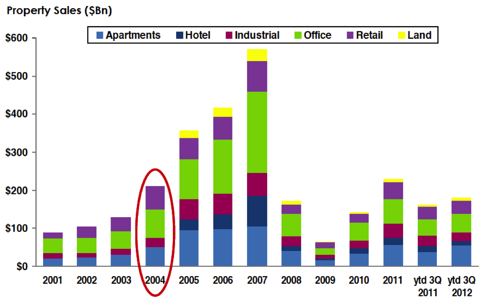

Investment sales opportunity

Investment sales volumes are significantly down from the peak, but have started to pick up and are back to 2004 levels. Mean reversion of property sales to normalized level will provide further tail wind to the HFF's business.

Source - HFF Company Presentation

Early cycle investments

As I pointed out earlier, adding capacity takes time given the relationship based nature of the business. HFF has been making early cycle investments and is well positioned to take advantage of this cyclical opportunity. Here is how?

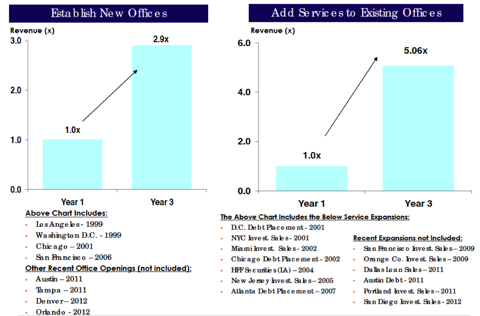

- HFF has been increasing footprint. HFF has added four new offices in CY 2011 and 2012 in Austin, Tampa, Denver and Orlando.

- Over past two years, HFF has also been adding new services to their existing offices.

- Most importantly. HFF has been aggressively adding production professionals. Since 2010, HFF has increased number of brokers by a third. HFF has added 55 new production professionals, taking the total of production professionals from 159 to 214.

Maturity curve for the new capacity

In my view, understanding the maturity curve for new capacity is the key to understanding the story.

According to the CEO, a new analyst starts producing at peak in 3-5 years while an lateral hire starts producing at peak within 2-4 yrs from the time of hiring. (Source - conference call transcripts). The new hires from 2010 are probably going to hit the peak in 2013 and 2014.

In the past, adding new services to an existing office has increased revenues to 5x in three years. While opening a new office has shown revenues tripling by the third year. The investments made in expansion since 2010 will start showing significant returns beginning next year.

Source - Company presentation.

HFF has also been gaining market share. Market share growth in origination volume of HF Growth Vs Industry Growth.

- 2011: HF 87% Vs Industry 55%

- 2010 : HF 88% Vs Industry 44%

Competition

HFF Competes with CBRE(NYSE:CBG),Jones Land LaSalle (NYSE:JLL) and Cushman & Wakefields of the world. The key difference with HFF is that it does not compete with clients and capital providers, unlike some of its competitors.

Valuation

HFF trades at 9x (ex-cash) earnings & ~5x EBITDA.

CBG and JLL trade at ~12-15x earnings & ~8-9x EBITDA.

HFF is a pure transactional company should trade at some discount to its comps which have revenue mix of contractual and transactional fees.

What is street missing? Why it may be trading cheap.

- HFF results can be lumpy. Street has not fully adopted to the lumpiness in HFF's business perhaps because HFF comps are not that lumpy. Street focuses too much on quarter to quarter volumes.

- HFF has limited coverage. CBG, JLL are large cap, better owned and better covered.

- HFF is an easier to own when volumes are growing instead of when volumes are sideways.

- But as the cyclical opportunity in CRE re-fi realizes and market gets more clarity, expect the earnings to improve and multiple to expand as well.

Price Target

HFF has no corporate debt and $4.10/sh cash. The management team is very conservative. Insiders own 29% and management/shareholder interests are well aligned.

The cash position of the company and the assured deal flow volumes from the debt re-fi opportunity should limit the downside.

HFF will do ~70M in EBITDA this year. Even a modest growth of 15% from volume pickup will put them at 80M EBITDA next year.

As market gets more clarity on the volume growth, HFF shareholders will be rewarded with a higher multiple. I am putting $20-22 price target on HFF common stock, representing 50% upside in less than a year.

Disclosure: I am long HF.

Email me to receive a more detailed thesis (powerpoint deck).

Category Commercial Real Estate, CRE, HF, HFF, Speciality financials

Powered by Blogger.